EXANTE has offered its services for 12 years already. Investors know this broker for its lack of minimum commissions when trading stocks and ETFs. However, it will change soon. Its customers noticed a popup after logging in informing them that EXANTE introduces minimum commissions.

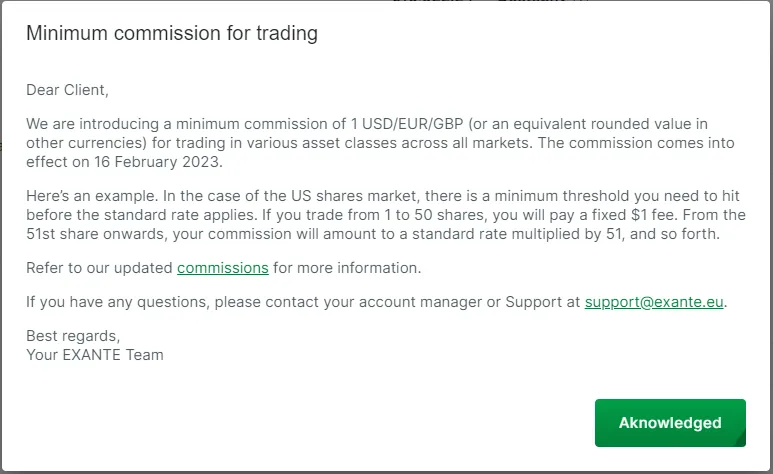

Minimum commission for trading

Dear Client,We are introducing a minimum commission of 1 USD/EUR/GBP (or an equivalent rounded value in other currencies) for trading in various asset classes across all markets. The commission comes into effect on 16 February 2023.

Here’s an example. In the case of the US shares market, there is a minimum threshold you need to hit before the standard rate applies. If you trade from 1 to 50 shares, you will pay a fixed $1 fee. From the 51st share onwards, your commission will amount to a standard rate multiplied by 51, and so forth.

Refer to our updated commissions for more information.

If you have any questions, please contact your account manager or Support at support@exante.eu.

Best regards,

Your EXANTE Team

It is not the nicest welcome message for EXANTE clients. Moreover, the broker did not send any e-mail about it so far. If none is sent, many clients may learn about commissions change after the fact. Your broker should not expect you that check the platform when you do not plan to buy or sell anything.

EXANTE introduces minimum commissions and confusion

There are also some open questions regarding not filled orders. How will commissions change affect pending “Limit” orders? If such an order fills before 16th February, the situation is clear. What if not? Popup does not clarify it in any way. Will all pending orders be canceled on that day? We will see how EXANTE approaches it.

Is EXANTE still a viable choice?

Despite introducing these minimum commissions, EXANTE remains one of a few brokers from Europe offering access to American ETFs. Its services in that matter are still the cheapest in the European Union. Moreover, its overall offer is still competitive because of access to more than 50 markets and 600.000 instruments. There is no information about plans of introducing custody fees for stocks & ETFs. We assume such a risk is very low, taking into consideration that another popular broker in Europe – Saxo Bank – decided recently to eliminate the custody fee.

Rankings update

The minimum commission for trading comes into effect on 16 February 2023. However, we have already updated our rankings. A period of fewer than 2 weeks should not affect your decision on where you want to open a brokerage account.